Delving into the depths of credit score determination, one must navigate through a labyrinthine maze of factors and algorithms. Understanding this enigmatic process is crucial in unraveling the mysteries that lie behind every individual’s financial standing.

An Elaborate Tapestry Woven by Multifarious Elements

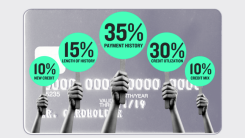

Within the intricate tapestry of credit score calculation, an amalgamation of diverse elements intertwines to shape one’s financial reputation. The first thread woven into this complex fabric is payment history, which scrutinizes an individual’s punctuality in meeting their monetary obligations.

A second strand weaves its way through the tapestry: amounts owed. This factor examines not only the total sum owed but also delves into utilization rates on various lines of credit, providing insight into an individual’s ability to manage debt responsibly.

Moving further along this convoluted path lies another determinant: length of credit history. By assessing how long an individual has been utilizing credit facilities, lenders gain valuable insights into their reliability and consistency over time.

The Weighty Significance of Credit Mix and New Credit

Credit mix forms yet another pivotal component within this intricate framework. Evaluating the diversity among different types of accounts held by individuals allows lenders to gauge their adaptability and versatility when it comes to managing various financial commitments.

Last but certainly not least, new credit emerges as a decisive factor in shaping one’s overall creditworthiness. Examining recent applications for additional lines or extensions reveals potential risks associated with excessive borrowing or sudden changes in financial circumstances.

A Mosaic Culmination Reflecting Financial Aptitude

In conclusion, each element intricately interwoven within the vast mosaic that constitutes your credit score holds paramount importance. By comprehending the multifaceted nature of credit score determination, individuals can navigate this labyrinthine realm with greater confidence and make informed decisions to enhance their financial standing.